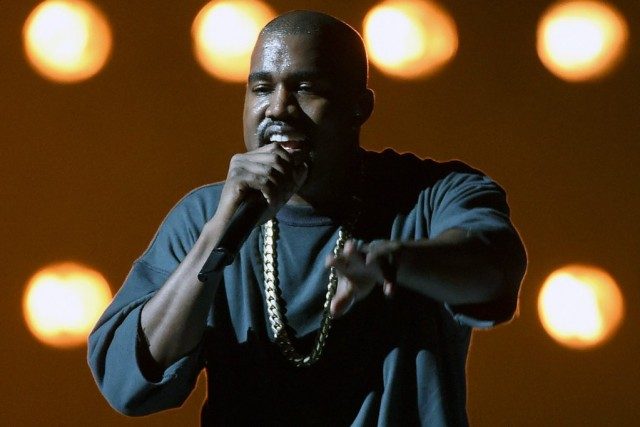

Last year, Kanye West canceled a portion of his Saint Pablo Tour after suffering a widely publicized mental health crisis.

Last year, Kanye West canceled a portion of his Saint Pablo Tour after suffering a widely publicized mental health crisis.

Earlier this month, his company filed a $10 million lawsuit against various entities of Lloyd’s of London, claiming the insurer was stalling on paying out claims related to the canceled dates. West’s breakdown was a genuine, unforeseen, and debilitating medical condition that prevented him from touring, the rapper’s lawyers argued, and therefore Lloyd’s owed him.

Lloyd’s has now struck back, citing exclusion clauses in West’s policy related to pre-existing psychological conditions, alcohol and illegal drug use, and nonprescription use of prescription drugs. “Underwriters’ investigation indicates substantial irregularities in Mr. West’s medical history,” Lloyd’s representatives wrote. The insurer said it’s not disclosing details “in order to protect the privacy of Mr. West,” but the exclusions cited certainly offer a hint.

West’s initial lawsuit also suggested that drug use allegations played a role in Lloyd’s decisions.

“Nor have they provided anything approaching a coherent explanation about why they have not paid, or any indication if they will ever pay or even make a coverage decision, implying that Kanye’s use of marijuana may provide them with a basis to deny the claim and retain the hundreds of thousands of dollars in insurance premiums,” West’s lawyer wrote.

Lloyd’s lawyers in the Kanye West case are the same ones who represented the insurer against the Foo Fighters in the band’s 2015 insurance lawsuit, which stemmed from concerts canceled because of Dave Grohl’s broken leg and the Bataclan terror attacks.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate