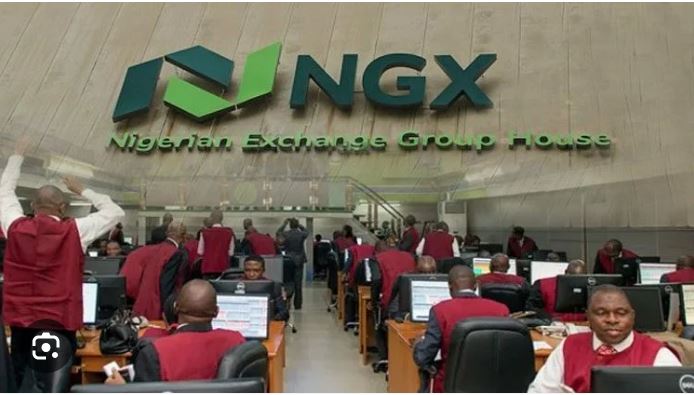

In recent market developments, equity investors have incurred losses amounting to N67 billion due to sell-offs in the stock market. This downturn highlights the volatility and challenges faced by investors in the equity market, emphasizing the importance of understanding market dynamics and risk management strategies. The Infosride delves into the details of the sell-offs, potential factors contributing to the market decline, and considerations for investors navigating these fluctuations.

Overview of the Market Situation:

Equity investors have faced a challenging period, resulting in a collective loss of N67 billion due to sell-offs in the stock market. The sell-offs indicate a trend of investors divesting from their equity holdings, potentially driven by a range of factors influencing market sentiment.

Factors Contributing to Sell-Offs:

1. **Market Sentiment:** Investor sentiment plays a crucial role in market dynamics. Negative sentiment, driven by factors such as economic uncertainties, geopolitical events, or global market trends, can trigger sell-offs as investors seek to mitigate potential losses.

2. **Economic Indicators:** Economic indicators, such as inflation rates, interest rates, and GDP growth, can influence investor decisions. Unfavorable economic conditions may prompt investors to reevaluate their portfolios and divest from equities.

3. **Company Performance:** The performance of individual companies and sectors can impact overall market sentiment. Poor financial results, management issues, or industry-specific challenges can lead investors to sell their shares in affected companies.

4. **Global Events:** Events on the global stage, such as geopolitical tensions, trade disputes, or health crises, can have ripple effects on financial markets. Investors may react to these events by adjusting their portfolios, contributing to sell-offs.

**Considerations for Investors:**

1. **Diversification:** Diversifying a portfolio across different asset classes and sectors can help mitigate risks associated with market fluctuations. A well-diversified portfolio is less susceptible to the impact of negative developments in specific stocks or sectors.

2. **Risk Management:** Implementing effective risk management strategies is essential for investors. This includes setting stop-loss orders, defining risk tolerance, and regularly reviewing and adjusting investment portfolios based on changing market conditions.

3. **Long-Term Perspective:** Investors with a long-term perspective may choose to ride out short-term market fluctuations. Focusing on the fundamental strength of investments and their growth potential over time can help weather periodic downturns.

4. **Stay Informed:** Keeping abreast of market news, economic indicators, and company performance is crucial for making informed investment decisions. Regularly monitoring market trends and staying informed about potential risks and opportunities can guide investor strategies.

**Market Recovery and Future Outlook:**

Markets are inherently cyclical, and downturns are often followed by periods of recovery. Investors should consider the historical resilience of markets and the potential for future rebounds. Positive economic developments, policy changes, or corporate performance improvements can contribute to market recovery.

**The Infosride’s Ongoing Market Coverage:**

As equity investors grapple with a N67 billion loss from sell-offs, The Infosride remains committed to providing ongoing market coverage. Stay tuned for updates on market trends, insights into factors influencing investor decisions, and comprehensive reporting on developments shaping the financial landscape.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate