The Central Bank of Nigeria (CBN) has announced a 150 basis points increase in the interest rate, raising the Monetary Policy Rate (MPR) from 24.75 percent to 26.25 percent.

This decision, reached during the bank’s Monetary Policy Committee (MPC) meeting held on the 20th and 21st of May 2024, marks the third consecutive hike aimed at addressing the country’s surging inflation rate, which stood at 33.69% in April 2024.

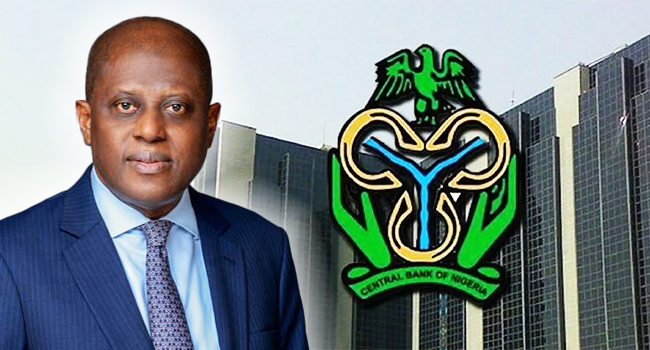

CBN Governor Yemi Cardoso, who also chairs the MPC, stated, “The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its 295th meeting… to review recent economic and financial developments and assess risks to the outlook.”

In addition to the MPR increase, the MPC retained the Cash Reserve Ratio (CRR) of Deposit Money Banks (DMBs) at 45 percent, while maintaining the Asymmetric Corridor around the MPR at +100 and -300 basis points. The liquidity ratio was also kept unchanged at 30 percent.

Cardoso acknowledged the mounting inflationary pressures in the country, attributing them primarily to food inflation fueled by factors such as rising transportation costs, infrastructure challenges, insecurity, and exchange rate fluctuations.

The announcement follows a period of escalating commodity prices and a rise in the cost of living, driven in part by the removal of fuel subsidies and the floating of the naira. Despite calls for patience from President Bola Tinubu, who remains optimistic about government reforms, the challenge of high inflation persists.

In recent months, the CBN has implemented measures targeting the operations of cryptocurrency exchange Binance in an effort to stabilize the value of the naira. While these measures initially led to currency appreciation, recent weeks have seen a stall in these gains.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate