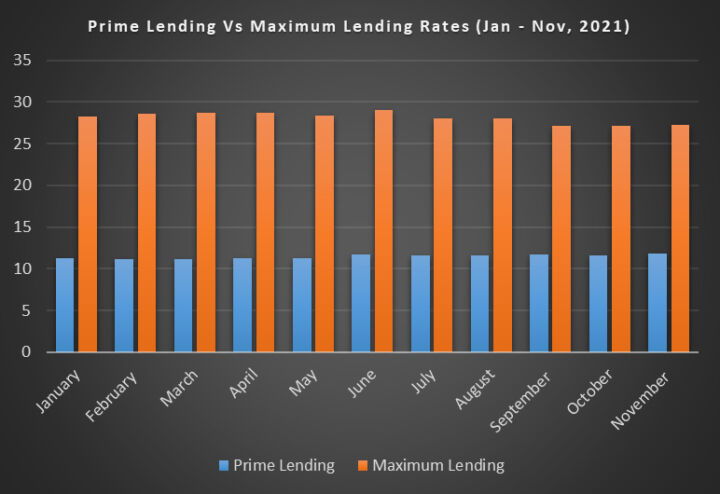

June was the toughest month for most borrowers. Then, the maximum interest rate, the statistics said, was 29.05 per cent as against prime borrowing cost of 11.67 per cent.

Prime borrowers are individuals and organisations whose perceived credit risks are below average. The categories of borrowers are likely to make full payments on time. Facilities to such individuals are often priced lower than the market rate.

While the prime-lending rate is lower than the maximum loan price globally, the difference between prime and non-prime credits is often far wider than the global average.

Last year, non-prime borrowers, including small and medium enterprises (SMEs), paid an average of 145 per cent as cost of funds higher than the multinationals, big corporations and others considered as prime borrowers, an analysis of money market indicators have shown.

According to the document sourced from the Central Bank of Nigeria (CBN) yesterday, prime borrowers paid an average of 11.47 per cent as interest rate from January to November last year. The rate is 16.64 percentage points less than the average maximum interest rate of 28.1 per cent paid by other borrowers.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate