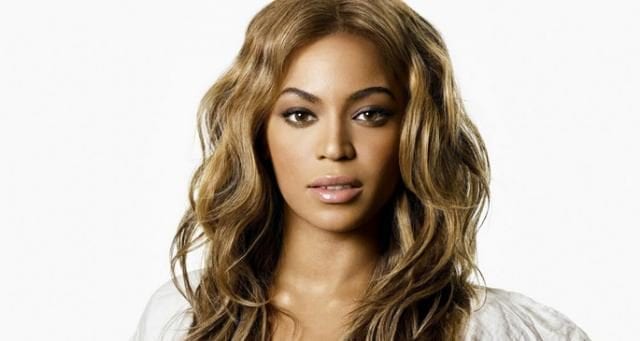

It was intriguing to learn that billionaire superstars Beyonce Knowles and her husband Jay-Z financed the purchase of their $88 million Californian mansion last year with a $53m mortgage from Goldman Sachs.

It was intriguing to learn that billionaire superstars Beyonce Knowles and her husband Jay-Z financed the purchase of their $88 million Californian mansion last year with a $53m mortgage from Goldman Sachs.

The Wall Street Journal revealed that the power couple’s mortgage payments will be more than $200,000 a month, with a fixed interest rate of 3.4 per cent that will become adjustable in 2022.

Is it any wonder that with money so cheap even the richest American entertainers are tempted to treat their home as a giant ATM?

With US stock markets seemingly on a never ending upward trajectory you can easily forgive this exuberance. But as so often in show business appearances are deceptive.

Hip-hop star Jay-Z has a track record as an entrepreneur. The music streaming business Tidal that he bought for $56m two years ago is currently valued at about $600m, partly thanks to its role as the exclusive launch platform for his wife’s last album Lemonade.

He and his equally famous wife are worth a total of $1.25 billion on the latest Forbes list. Her annual earnings? Around $100m; but Jay-Z’s fortune is reckoned to be the larger at $900m.

Perhaps if you have Jay-Z’s flair for private equity investment and business then borrowing against your real estate assets at low rates is always going to be a winner.

However, any personal financial adviser would have to counsel against such an approach for the average investor.

Indeed, for the average person who’s just come into some money it would probably be one of the surest routes to financial suicide.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate