Cyberport

led

over

30

start-ups

to

present

their

innovative

FinTech

solutions

and

their

next-generation

ideas

at

the

AFF

Simon

Chan,

Chairman

of

Cyberport,

stated

in

his

welcome

remarks,

“As

we

embark

on

our

journey

to

becoming

a

digital-first

financial

centre,

we

must

embrace

the

transformative

power

of

forefront

technologies

such

as

AI,

and

rethink

our

strategies

towards

a

more

sustainable

future

in

the

financial

sector.

With

over

430

FinTech

companies

based

at

Cyberport,

we

are

uniquely

positioned

to

foster

an

innovative

FinTech

ecosystem

in

Hong

Kong.

We

work

closely

with

the

Government

and

key

partners

to

actively

drive

the

application

of

innovative

technologies

in

the

financial

sector.

Our

commitment

to

sustainable

and

innovative

technology

development

is

evident

in

our

unwavering

support

for

start-ups

that

are

pioneering

solutions

in

green

finance

and

digital

innovation.

Together,

we

will

continue

to

collaborate

with

various

sectors

to

meet

the

challenges

ahead

and

collectively

build

a

more

inclusive,

efficient,

and

sustainable

future

for

the

financial

services

industry.”

Cyberport co-hosted a thematic workshop titled “Accelerating Financial Innovation: Hong Kong’s Journey Towards a Digital-First Financial Centre“. The workshop highlighted Hong Kong’s strategic initiatives in embracing advanced financial technologies and nurturing an innovative financial ecosystem. The session featured discussions on the Hong Kong Monetary Authority’s Sustainable Finance Action Agenda, which aims to achieve net-zero emissions and catalyse sustainable finance development. FinTech leaders also shared real-world applications of transformative technologies in the financial sector, illustrating how these innovations can be powerful drivers for positive change in the economy.

Additionally, a kick-off ceremony was held for The Green and Sustainable FinTech Proof-of-Concept Funding Support Scheme projects during the event. Launched by the Financial Services and the Treasury Bureau (FSTB) and administrated by Cyberport, this scheme promotes green and sustainable FinTech development in Hong Kong. From over 100 proposals received, 60 projects were selected after an expert review.

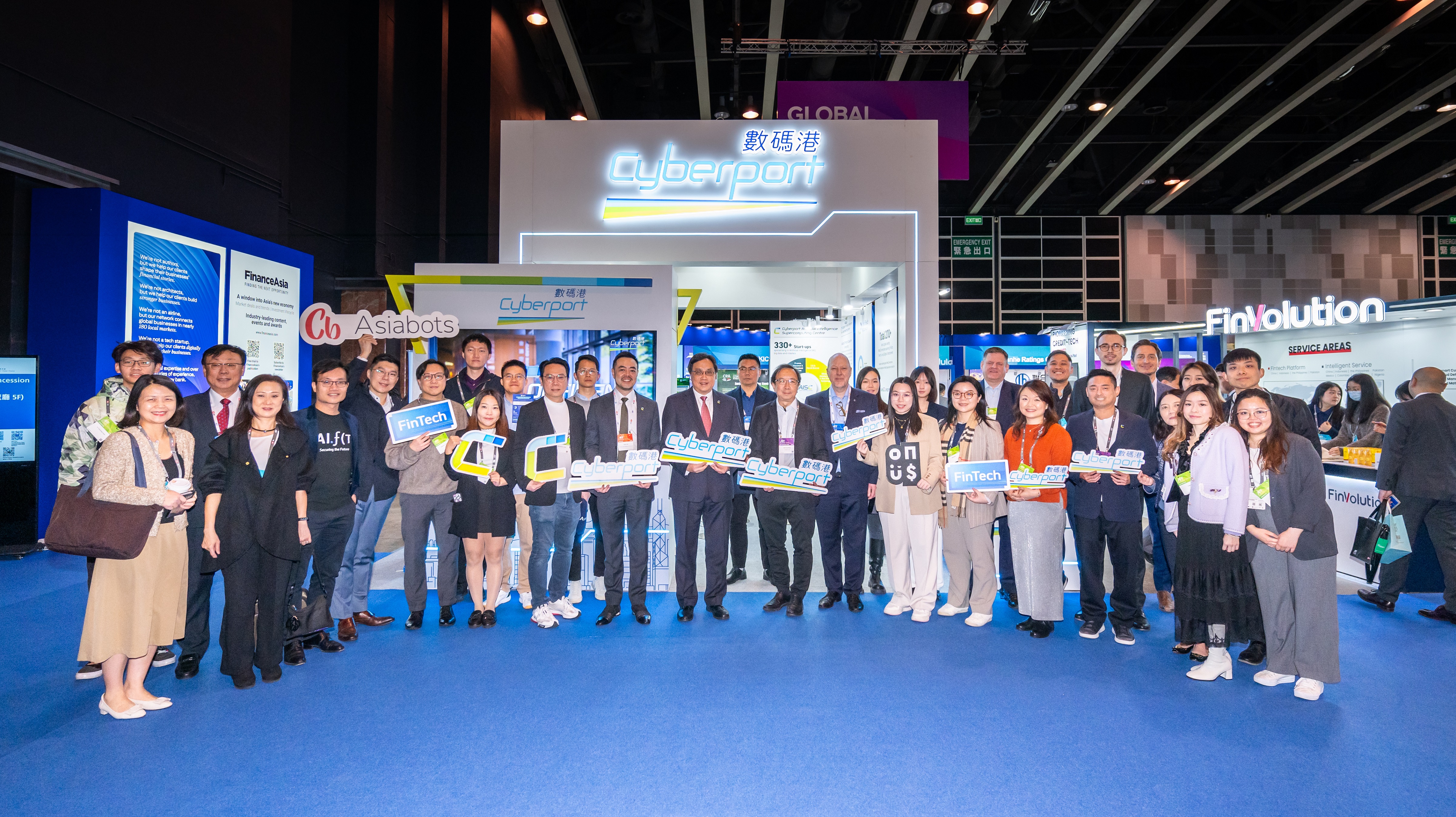

On the other hand, a dedicated Cyberport Pavilion was also featured in the event, where eight community members presented various FinTech solutions to address contemporary financial challenges, such as digital assets, RegTech, WealthTech, InsurTech, and ESG/Green Finance. Additionally, dozens of FinTech companies from the Cyberport community showcased their innovative ideas to global investors, partners, and business leaders at the forum. These startups are making significant contributions to the rapidly evolving financial market by providing cutting-edge financial technology.

Playing

a

vital

role

in

promoting

Hong

Kong’s

FinTech

development,

Cyberport

houses

more

than

430

FinTech

start-ups

and

technology

companies

covering

digital

assets,

virtual

insurers,

virtual

banks,

electronic

payments,

and

WealthTech.

The

Cyberport

community

also

includes

five

FinTech

unicorns,

namely

ZA

International,

WeLab,

TNG,

CertiK,

and

HashKey,

as

well

as

three

Hong

Kong-licensed

virtual

asset

trading

platforms:

HashKey,

HKVAX

and

HKbitEX.

The issuer is solely responsible for the content of this announcement.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate