In a significant breakthrough following months of intense negotiations, the Ghanaian government has successfully reached an agreement with the official creditors committee to restructure a substantial $5.4 billion in bilateral loans. This pivotal development is poised to set the stage for a formalization of terms through a memorandum of understanding, with subsequent implementation facilitated by bilateral accords.

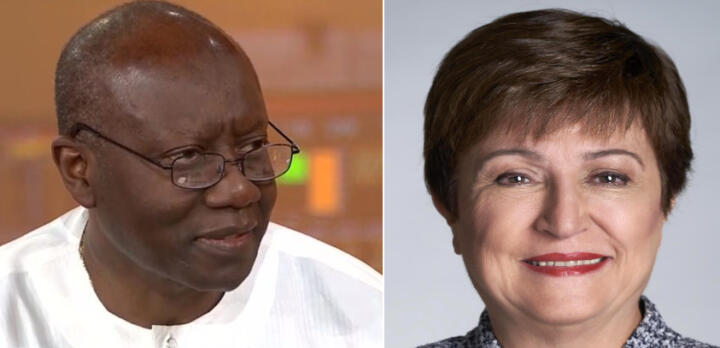

Finance Minister Ken-Ofori Atta, in a post on X, hailed the agreement with official creditors, a coalition that includes the Paris Club and China. He emphasized that this marks a significant stride toward restoring Ghana’s long-term debt sustainability, underscoring the nation’s commitment to navigating its financial challenges.

The negotiation process unfolded under the auspices of the G20 Common Framework, designed for comprehensive debt treatment. Ofori-Atta asserted that the deal is expected to catalyze an immediate infusion of $1.25 billion into the Ghanaian economy. This includes a second disbursement of $600 million from the International Monetary Fund (IMF), part of a broader $3 billion bailout program for Ghana.

Kristina Georgieva, Managing Director of the IMF, expressed appreciation for the Official Creditor Committee’s diligent efforts, especially acknowledging the co-chairs, China and France, for their instrumental role in reaching this pivotal agreement. She highlighted this achievement as another significant milestone for the G20 Common Framework, showcasing the collaborative efforts of G20 creditors in providing debt relief to Ghana.

For context, the IMF has a $3 billion bailout program in place for Ghana, aimed at bolstering the country’s macroeconomic stability and fostering debt sustainability. The program entails annual disbursements of $600 million to Ghana from 2023 to 2027, contingent on the government reducing its public debt-to-GDP ratio to 55% by 2028. Before the initiation of the program in 2023, Ghana’s debt-to-GDP ratio was projected to reach a staggering 109%.

In alignment with the program’s conditions, Ghana has already completed a domestic debt restructuring and implemented fiscal adjustments, aiming to bring down its debt-to-GDP ratio to 72% by 2028. However, to secure further relief, the nation must navigate debt restructuring negotiations with bilateral lenders and commercial creditors.

While the deal with official creditors nears its conclusion, attention now turns to addressing obligations with commercial creditors. Notably, in December 2022, Ghana took the proactive step of suspending debt service payments on Eurobond loans, commercial loans, and bilateral debts. This suspension encompassed payments on Eurobonds, commercial term loans, and a significant portion of bilateral debt.

In a subsequent move in October 2023, Finance Minister Ken-Ofori Atta proposed a potential 40% reduction of the principal amount for commercial creditors, including the $13 billion global bondholders. Explaining the restructuring terms, Ofori-Atta outlined a nominal haircut between 30% and 40%, coupled with coupons not exceeding 5% and final maturities of no more than 20 years.

Anticipations are high that the successful negotiation with official creditors will provide valuable leverage in ongoing talks with commercial creditors, including bondholders. Ofori-Atta emphasized the interconnectedness of these agreements, stating that the recent accord with official creditors will bolster engagements with Ghana’s commercial creditors, paving the way for continued progress in the nation’s journey toward financial stability and sustainability. Infostride News will continue to monitor and report on the unfolding developments in Ghana’s debt restructuring process.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate