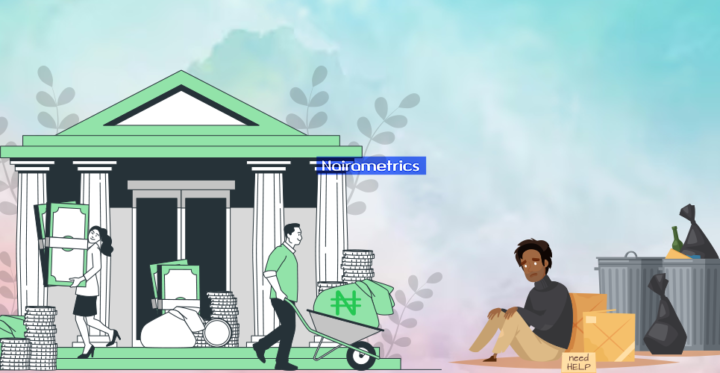

The surge in impaired loans within Nigerian banks is attributed to the repercussions of recent policy changes. This development underscores the impact of shifts in economic and regulatory environments on the financial stability of banking institutions.

The rising trend of impaired loans signals a complex interplay of factors influenced by policy adjustments. These changes, whether in economic strategies or regulatory frameworks, have ramifications on the financial health of banks, potentially affecting their asset quality and overall risk management.

The fallout from policy changes in Nigerian banks is reflective of the dynamic nature of the financial landscape. Economic policies and regulatory decisions can introduce uncertainties, influencing lending practices, borrower behavior, and the overall credit quality within the banking sector.

The term “impaired loans” typically refers to loans that face a higher likelihood of non-repayment due to factors such as economic downturns, changes in borrower circumstances, or adverse policy shifts. The increase in impaired loans underscores the importance of proactive risk management strategies by banks to navigate challenges arising from external factors.

The consequences of policy adjustments on impaired loans highlight the need for adaptability and resilience within the banking sector. Banks may need to reassess their risk management frameworks, enhance credit monitoring, and adjust lending practices to align with the evolving economic and regulatory landscape.

The recognition of impaired loans as a fallout of policy changes emphasizes the interconnectedness of policy decisions, economic dynamics, and the financial health of banks. The response to this challenge requires a coordinated effort from both regulatory authorities and banking institutions to mitigate risks and ensure the stability of the financial system.

In conclusion, the surge in impaired loans within Nigerian banks is portrayed as a consequence of recent policy changes. This scenario underscores the importance of a nuanced understanding of the impacts of policy adjustments on the financial sector and the necessity for adaptive strategies to navigate evolving economic and regulatory landscapes.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate