Source:

Shutterstock

In

the

early

hours

of

the

Asian

trading

session

on

6

November,

as

the

first

results

of

the

U.S.

Presidential

elections

started

to

hit

the

wires

and

it

became

increasingly

clear

that

Donald

Trump

would

return

to

the

White

House,

Bitcoin

(BTCUSD)

hit

a

new

all-time

high.

According

to

Coinbase,

BTCUSD

closed

at

75,645

on

6

November,

above

the

previous

record

of

73,835.

Since

then,

Bitcoin

has

been

establishing

new

all-time

highs

essentially

every

single

day.

Overall,

it

has

risen

by

more

than

30%

since

5

November.

The

stocks

of

companies

either

directly

or

indirectly

involved

in

cryptocurrencies,

such

as

Nvidia

and

MicroStrategy,

also

marched

higher

in

response

to

election

results.

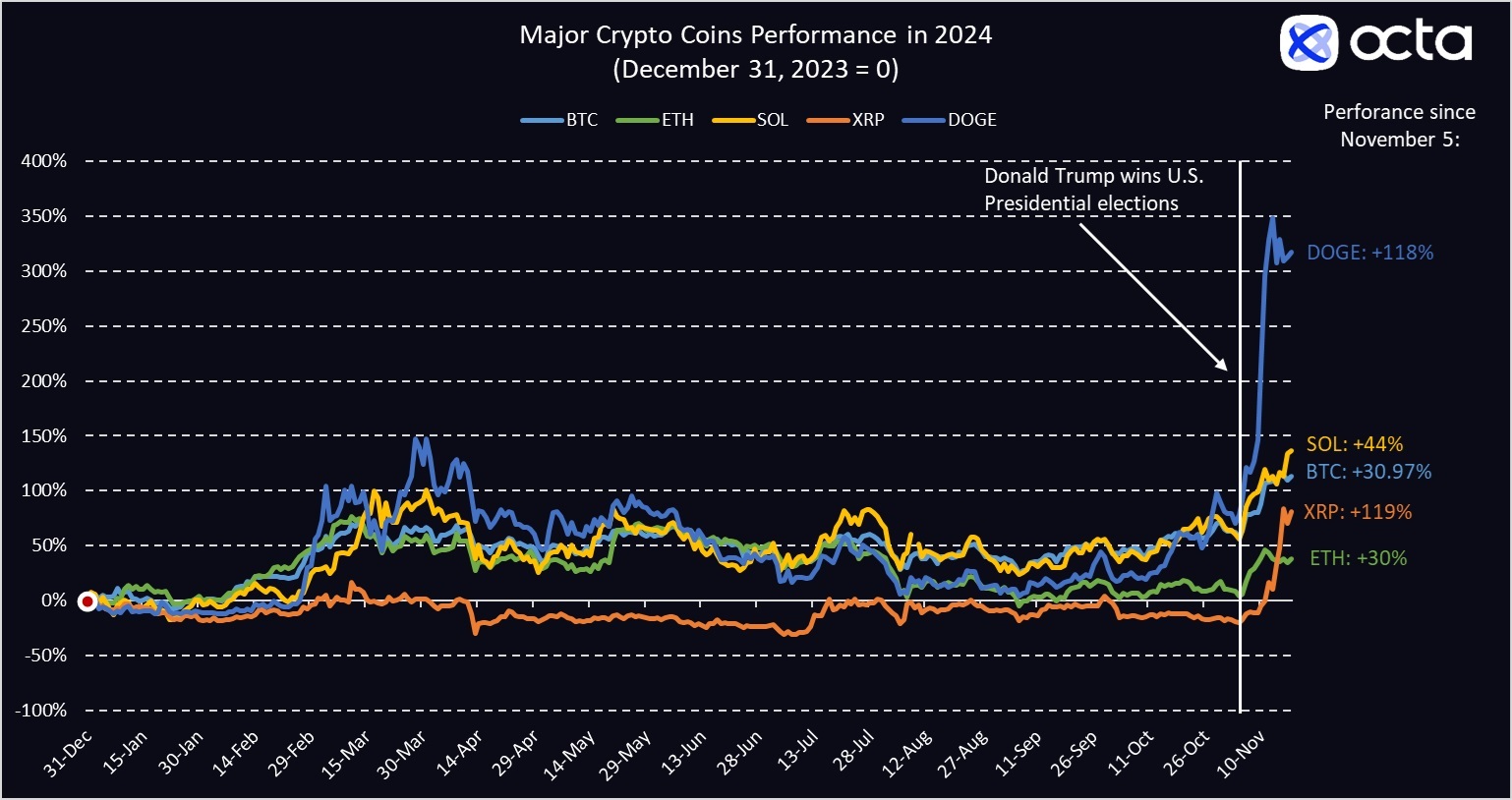

Such a favourable market reaction to Trump’s victory stems from investors’ belief that his Administration, coupled with a friendly Congress, will effectively deregulate the crypto industry, facilitate its expansion and implement a coherent regulatory framework that will serve investors and consumers for years to come. ‘It should be said, argues Kar Yong Ang, a financial market analyst at Octa broker, that this belief is not without foundation. Trump has managed to lure many crypto fans to his side with his bold moves, clear views and a strong focus on deregulation’.

Indeed,

as

Octa

explained

in

some

of

its

previous

materials,

Trump

has

been

a

lot

more

explicit

in

his

support

of

crypto

than

Kamal

Harris.

Unsurprisingly,

many

crypto

enthusiasts,

as

well

as

some

serious

crypto

investors,

supported

Trump

over

Harris.

For

example,

in

a

rather

bold

move,

Donald

Trump

attended

a

Nashville

Bitcoin

conference

in

July,

where

he

advocated

for

creating

a

federal

Bitcoin

reserve

and

highlighted

the

importance

of

attracting

more

Bitcoin

mining

operations

to

the

United

States.

Another

crypto-friendly

gesture

was

Trump’s

alleged

promise

to

fire

Gary

Gensler,

the

Chairman

of

the

Securities

and

Exchange

Commission

(SEC),

whom

many

in

the

cryptosphere

regard

as

an

adversary

due

to

his

numerous

lawsuits

against

crypto

projects.

Under

a

new

leader

appointed

by

Donald

Trump,

the

SEC

could

potentially

provide

a

more

favourable

regulatory

environment

for

digital

assets.

Furthermore,

now

that

Republicans

are

in

full

control

of

both

the

Senate

and

the

House

of

Representatives,

Donald

Trump

has

a

door

wide

open

to

push

forward

his

agenda.

This

is

what

the

official

2024

Republican

Party

Platform

said

about

crypto:

‘Republicans

will

end

Democrats’

unlawful

and

un-American

crypto

crackdown

and

oppose

the

creation

of

a

central

bank

digital

currency.

We

will

defend

the

right

to

mine

Bitcoin

and

ensure

every

American

has

the

right

to

self-custody

their

digital

assets

and

transact

free

from

government

surveillance

and

control’.

Needless to say, the new Congress is a lot more likely to enact legislation favourable to the crypto industry. ‘As things currently stand, I believe there is every reason to expect the approval of more crypto-focused ETFs [exchange-traded funds] that, for example, may be based on other cryptocurrencies, like Solana and XRP. Who knows, we might even get a Dogecoin ETF. Why not? Dogecoin is Elon Musk’s favourite crypto token, and Elon certainly has some weight on Trump’s team’, said Kar Yong Ang, a financial market analyst at Octa broker. Interestingly, according to CoinmarketCap, the value of Dogecoin has more than doubled since 5 November.

Major

Crypto

Coins

Performance

in

2024.

(31

December

2023

=

0)

Regulatory

easing

triggers

innovation,

and

more

crypto

products

may

enter

the

mainstream

financial

markets.

This

could

potentially

lead

to

increased

institutional

investment

in

cryptocurrencies,

as

ETFs

provide

a

more

accessible

and

regulated

way

for

investors

to

gain

exposure

to

the

market.

Despite the recent price surge and record-high valuations, Bitcoin remains in demand. On Monday, MicroStrategy Incorporated disclosed that it had added 52,000 Bitcoins to its portfolio worth $4.6 billion over the last week, marking the largest purchase in the company’s history. The key question now is—can the rally continue?

Kar Yong Ang, a financial market analyst at Octa Broker, has this to say: ‘Franky, I’m beginning to have a bad feeling about this naked optimism. Euphoria rarely ends well, and this euphoria has been going on for a bit too long now. When expectations run high, the risk of a major disappointment rises, and I think we might see increased volatility in Bitcoin with perhaps a major downward correction around the corner. At the same time, the long-term future looks bright, especially if the Trump administration does go ahead with its plan to establish a federal Bitcoin reserve’.

The exact mechanics of creating this new national Bitcoin reserve remain unclear. Still, if the U.S. government were to start acquiring Bitcoin through open market purchases, the potential upside for the cryptocurrency could be enormous. Also, the direct involvement of the U.S. government will significantly bolster Bitcoin’s intrinsic value and legitimise it as a mainstream asset. As Kar Yong Ang explains, ‘the supply of Bitcoin is limited, so assuming the U.S. government does not engage in direct mining, the only way to fill up the reserve is via direct purchases. This intention, if there is one, better be kept secret because it will certainly take Bitcoin to the moon’.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate