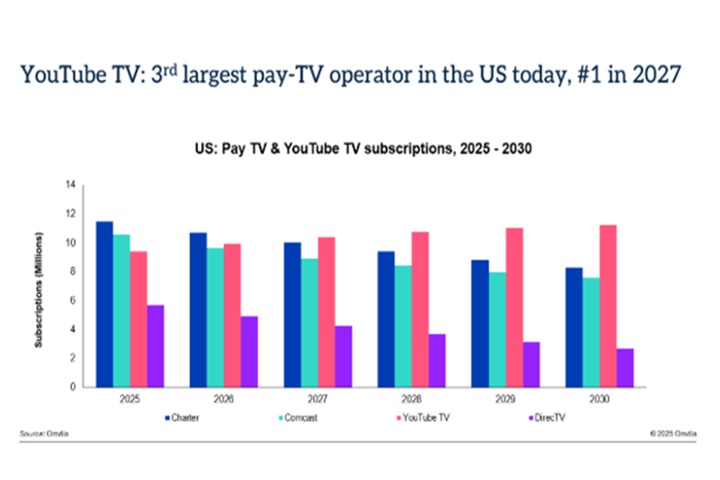

YouTube TV is on course to upend the traditional US television hierarchy, with new industry forecasts indicating that the Google-owned platform will become the largest pay-TV operator in the United States by 2027.

If realised, the shift would mark a historic milestone: the first time a virtual pay-TV service, rather than a cable or satellite provider, tops the American market.

According to fresh projections from media research firm Omdia, YouTube TV is expected to overtake long-established cable heavyweights Charter Communications and Comcast, signalling a decisive turning point in how Americans consume television content.

A Rapid Ascent in a Declining Market

Omdia’s analysis shows that while the overall US pay-TV market continues to shrink, YouTube TV is steadily gaining ground by appealing to viewers seeking flexibility without abandoning live television.

At the end of 2025, Charter remains the largest pay-TV operator with an estimated 11.4 million subscribers, followed by Comcast with 10.6 million. YouTube TV currently trails in third place with 9.3 million subscribers.

However, by 2027, the rankings are forecast to change dramatically. YouTube TV is projected to reach 10.4 million subscribers, surpassing Charter at 10.0 million and pushing Comcast down to 9.2 million.

Maria Rua Aguete, Head of Media and Entertainment at Omdia, described the development as a watershed moment for the industry.

“For the first time in US television history, the largest pay-TV operator will be a virtual provider,” she said. “YouTube TV has evolved into a comprehensive pay-TV bundle, combining linear channels, premium networks and major sports rights such as NFL Sunday Ticket. This is not simply another streaming service — it represents the future of pay television in the US.”

From Streaming Add-On to Full Pay-TV Alternative

YouTube TV’s growth reflects its success in blurring the line between traditional cable and modern streaming. Unlike on-demand platforms, the service offers live television alongside cloud DVR, premium add-ons and high-profile sports content, making it an increasingly viable replacement for cable subscriptions.

The acquisition of exclusive rights to NFL Sunday Ticket has proven particularly influential, drawing in sports fans who might otherwise have remained with legacy providers.

YouTube’s Unmatched Scale Gives It an Edge

Beyond YouTube TV, Omdia notes that YouTube’s broader ecosystem provides a strategic advantage unmatched by any other media company. With close to three billion global users, YouTube remains the largest video platform in the world by a wide margin.

Netflix may be approaching 300 million global subscribers, but against YouTube’s three billion users, it is not a dominant global force,” Rua Aguete observed. “YouTube operates at a scale no subscription-based service can replicate.

This dual position — global video dominance combined with rising pay-TV leadership — places YouTube in a uniquely powerful position as media consumption habits continue to evolve.

A Fragmented and Competitive Streaming Landscape

Omdia’s latest data also underscores how fragmented the US streaming market remains. Even as the largest individual streaming service, Netflix accounts for just 15.7% of total US subscription video-on-demand (SVOD) subscriptions.

Forecast subscriber figures for 2025 illustrate the competitive intensity:

- Netflix: 88.7 million

- Amazon Prime Video: 64.7 million

- Disney+: 55.8 million

- Paramount+: 49.4 million

- HBO Max: 29.7 million

“The notion of Netflix as a monopolistic force in streaming is misleading,” Rua Aguete said. “Consumer attention and spending are spread across numerous platforms.”

The Industry’s Shift Towards Hybrid Models

Omdia’s research points to a clear industry trend: audiences increasingly favour hybrid services that combine live TV, premium channels, sports, user-generated content and on-demand libraries. YouTube TV, supported by the wider YouTube ecosystem, exemplifies this shift.

The report also highlights growing consolidation pressures within Hollywood, with premium content libraries becoming ever more valuable.

“Paramount and Warner remain among the most strategically important assets in the global media market,” Rua Aguete added. “Interest from players such as Netflix or Paramount reflects the urgent need for scale, high-value intellectual property and worldwide distribution.”

A New Era for US Television

If Omdia’s forecasts hold true, YouTube TV’s rise will symbolise more than just a reshuffling of subscriber rankings. It will confirm that the future of pay television lies not with traditional cable infrastructure, but with flexible, internet-delivered platforms capable of merging live and on-demand viewing.

By 2027, America’s largest pay-TV provider may no longer be a cable giant — but a digital-first platform born on the internet, reshaping television for a new generation of viewers.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate