(from

left

to

right)

Mr

Robert

Lui,

Divisional

Councillor

of

CPA

Australia

2024

in

Greater

China;

Ms

Karina

Wong

Divisional

Deputy

President

of

CPA

Australia

2024

in

Greater

China;

Mr

Cliff

Ip,

Divisional

President

of

CPA

Australia

2024

in

Greater

China;

Mr

Cyrus

Cheung,

Divisional

Deputy

President

of

CPA

Australia

2024

in

Greater

China

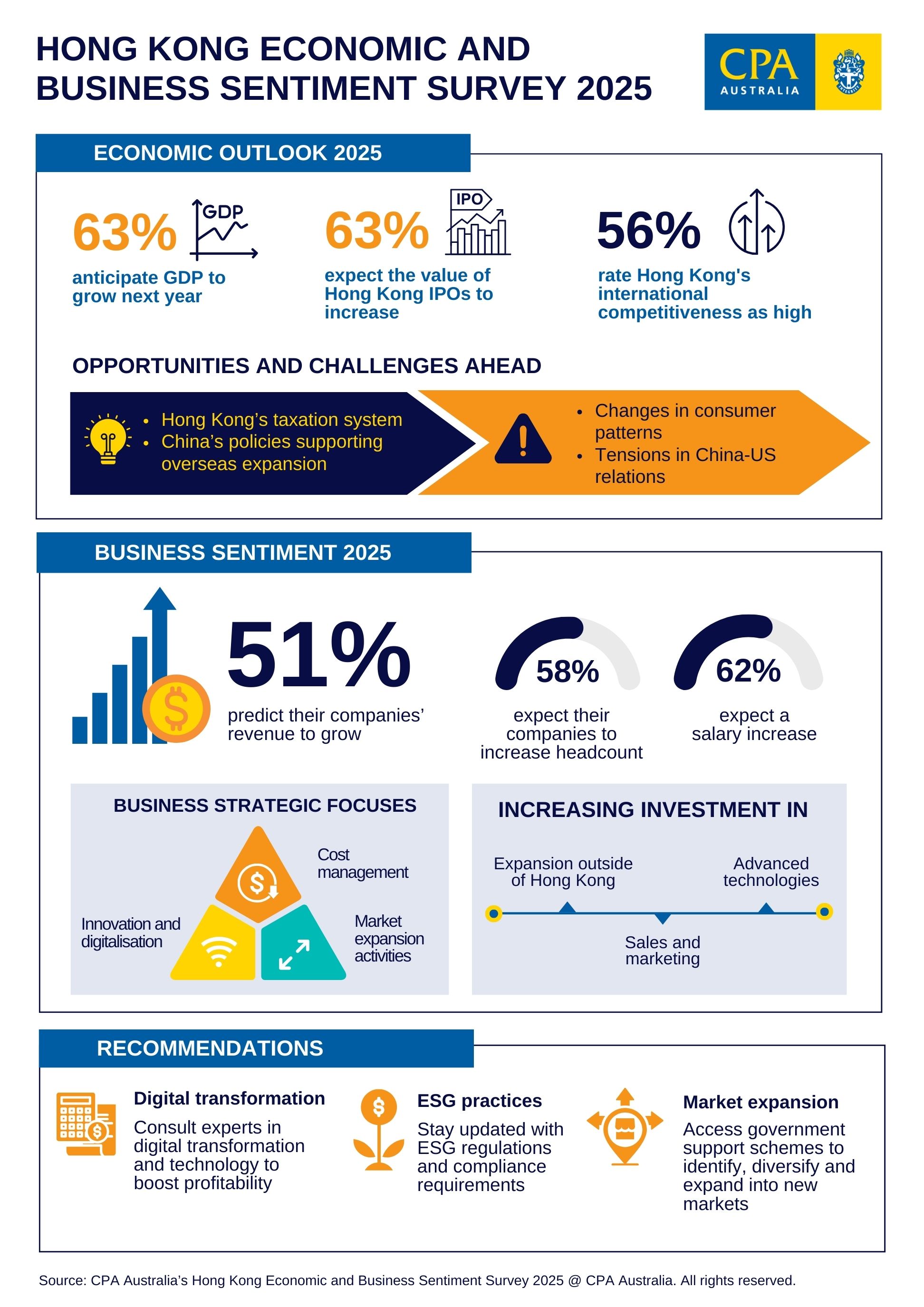

Surveyed

executives

and

accounting

professionals

show

a

relatively

optimistic

outlook

for

Hong

Kong’s

economy,

with

63

per

cent

anticipating

the

local

economy

will

grow

next

year.

Hong

Kong’s

tax

system

(31

per

cent)

ranks

as

the

largest

positive

contributor

to

the

city’s

economic

and

business

environment

in

2025,

while

changes

in

consumer

patterns

(26

per

cent)

and

tension

in

US-China

relations

(26

per

cent)

are

seen

to

be

the

two

biggest

challenges.

56

per

cent

of

respondents

rated

Hong

Kong’s

international

competitiveness

as

high.

Mr. Cliff Ip, CPA Australia 2024 Divisional President of Greater China, said, “The survey findings reflect that Hong Kong’s economy and business confidence are expected to steadily improve in the coming year. Recent stimulus measures unveiled by the central government and the Hong Kong government have contributed to this improved sentiment. The start of the rate-cutting cycle has also boosted business confidence. These positive factors should keep this momentum going into 2025 and strengthen Hong Kong’s international competitiveness.

“However, external uncertainties still weigh on some sectors such as tourism and retail. Respondents indicate that changing customer behaviour and weak customer demand are some of the key challenges they expect to face in 2025. In response, companies must keep innovating their products and services, and how they deliver them. They also need to frequently engage with customers and potential customers to better understand trends both in Hong Kong and elsewhere.”

The

outlook

for

initial

public

offerings

(IPOs)

in

the

city

is

also

optimistic.

Some

63

per

cent

of

respondents

expect

the

value

of

funds

raised

in

Hong

Kong

through

IPOs

to

increase

in

2025.

“IPO

activity

in

Hong

Kong

has

shown

signs

of

recovery

since

Q3

due

to

some

mega-sized

IPOs.

Policies

and

regulatory

reforms

are

stimulating

capital

activities

and

boosting

investor

confidence,”

Ip

explained.

The improving economic sentiment is flowing through to revenue projections and business expansion plans in 2025. 51 per cent of respondents predict their company’s revenue will grow next year, with an increase in revenue of between 5 to 20 per cent being the most popular prediction.

In response to this improving business environment, respondents are most likely to forecast that their company will increase their investment in advanced technologies (38 per cent), sales and marketing (37 per cent) and expansion outside of Hong Kong (36 per cent). A notably high proportion of respondents to this survey stated that their company has expansions plan in the next three years at home or abroad, with mainland China (40 per cent) again nominated as the most popular destination.

Though cost management remains the top strategic focus for many companies, the percentage choosing it has dropped from 39 per cent in 2024 to 27 per cent in 2025. While slightly more are expected to focus on market expansion activities (27 per cent) and innovation and digitalisation (26 per cent).

Ip stated, “The more positive business environment is being reflected in an expected shift in corporate strategy away from defensive strategies such as cost management and improving business efficiency towards more expansionary strategies such as market expansion and innovation.”

To support growing revenue and expansion plans, companies are keen to add more employees and increase salary to retain talent. 57 of per cent respondents expect that their companies to increase headcount, the highest new hiring intention since 2020. These new hiring intentions are strongest amongst larger companies. Salaries are expected to grow, with 62 per cent expecting to receive a salary increase in 2025.

While the economy looks to be on a positive trajectory, predictions for price changes in the property market in 2025 are uncertain, with similar numbers of respondents expecting prices to increase and decrease, however more respondents expect prices to increase than the previous two years.

Ip explained, “The city’s property market is recovering, with demand gradually growing. This is due to recent interest rate cuts and changes in government policies such as the relaxation of restrictive measures in the housing market. However, with sectors such as SMEs undergoing a relatively slower recovery due to the weak domestic demand, this is leading to stagnation in the rental market.”

The survey data shows nearly all Hong Kong companies have introduced at least some ESG measures into their operations, with only three per cent stating they have not taken any ESG actions. Another 35 per cent expect their company to increase their ESG-related initiatives and activities next year. Respondents were most likely to nominate compliance and increasing compliance costs as the biggest impact ESG is having on their business.

CPA Australia collected 568 responses from Hong Kong-based executives, accounting and finance professionals working in various industries in October and November for this Hong Kong Economic and Business Sentiment Survey 2025.

![]() https://www.cpaaustralia.com.au/

https://www.cpaaustralia.com.au/

![]() https://www.linkedin.com/school/cpaaustralia/

https://www.linkedin.com/school/cpaaustralia/

Hashtag: #CPAAustraliaHongKong #2025HongKongBusinessOutlook #Forecast #Advocacy #ThoughtLeadership #Accounting

The issuer is solely responsible for the content of this announcement.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate