Popularly referred to as the ‘Human ATM’, Firstmonie Agents are empowered to reduce the reliance on over-the-counter transactions while providing convenient, personalized services.

Amongst the services carried out by the Agents include; Account Opening, Cash Deposit, Airtime Purchase, Bills Payment, Withdrawals, and Money Transfer.

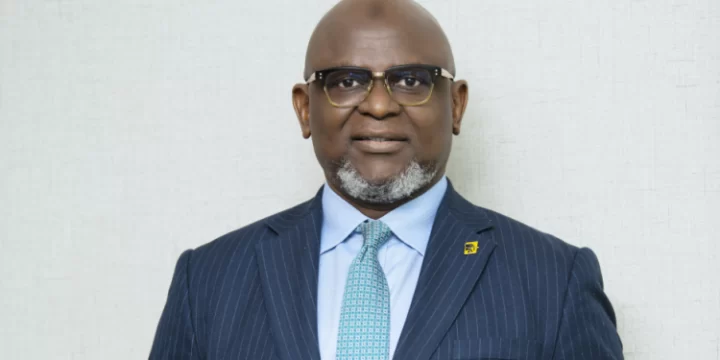

Expressing his appreciation to the Firstmonie Agents, the CEO, FirstBank, Adesola Adeduntan, said: “Since the relaunch of our Agent Banking scheme in 2018, our Firstmonie Agents have played a vital role in bridging the financial inclusion gap in the country, as many more people have been able to undertake various financial and business transactions in cost-effective ways, thereby saving a lot of time and money in traveling over long distances for basic banking services.”

“We are delighted by the giant strides of our Firstmonie Agents in promoting financial inclusion and commend them for their efforts in taking banking to the doorsteps of Nigerians – irrespective of where they are – in a very effective way”, he concluded.

Through various empowerment and reward schemes implemented to put its Firstmonie Agents at an advantage to economically impact their immediate communities whilst importantly having their business sustained, the Bank’s Agent Banking scheme has remained a toast to Nigerians, irrespective of where they are in the country.

Amongst these schemes is the Agent Credit – launched in 2020 – which has had the Bank provide credit facilities to the tune of 238 billion nairas to its teeming Firstmonie Agents.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate