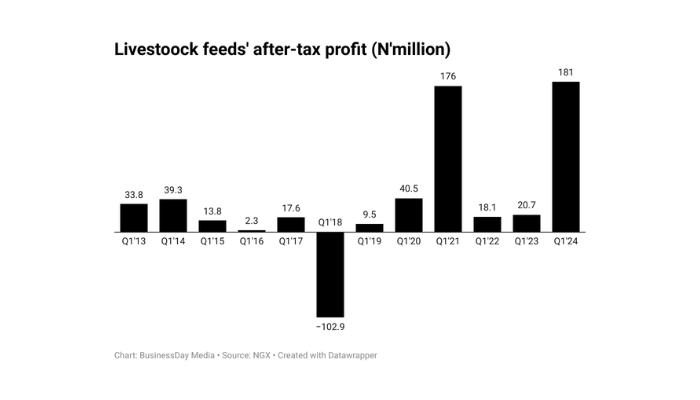

Livestock Feeds Plc, a prominent manufacturer of animal feeds in Nigeria, has reported a remarkable surge in earnings, with its after-tax profit soaring by 774.4 percent in just one year, according to its latest financial statement.

The company’s financial report reveals that its after-tax profit jumped to N181 million in the first quarter of this year from N20.7 million in the same period of 2023.

A deeper analysis of the statement shows that Livestock Feeds recorded a significant increase in revenue from contracts with customers, climbing to N7.14 billion from N4.8 billion.

This increase was primarily driven by robust sales of livestock feeds across various regions: Aba (N2.6 billion), Ikeja (N3 billion), Onitsha (N507.5 million), and the Northern parts of Nigeria (N985.7 million).

Established in 1963 by Pfizer as a subsidiary of its pharmaceutical business in Nigeria, Livestock Feeds operates two owned plants located in Ikeja and Aba, Nigeria, boasting a joint production capacity of well over 35 metric tonnes per hour. Additionally, it has operations in Onitsha and Jos.

The company serves Nigeria’s economic sub-sector of livestock, which includes activities such as poultry, aquaculture, cattle, sheep and goat rearing, piggery, and rabbitry.

In terms of financial performance, Livestock Feeds reported that its cost of sales surged by 34.4 percent to N6.04 billion from N4.5 billion, while its gross profit increased to N1.09 billion in the first quarter of 2024 from N352.4 million.

Selling and distribution expenses rose to N70.6 million from N50.7 million, and administrative expenses also increased to N300.6 million from N157.8 million. Despite these increases in expenses, the company’s operating profit surged by 358.4 percent to N739.9 million in the first quarter of 2024 from N161.4 million.

However, the company reported a decrease in finance income to N236,000 from N280,000, while its finance costs increased significantly to N469.9 million from N130.9 million.

Livestock Feeds also reported an increase in net cash flow used in operating activities, rising to N3.5 billion from N459 million. Similarly, net cash flow used in financing activities increased to N3.2 billion from N547.6 million in the first quarter of 2023.

The company’s non-current assets on property, plant, and equipment increased to N1.2 billion in the first quarter of 2024 from N1.15 billion, reflecting its ongoing investment in infrastructure and capacity expansion.

Overall, Livestock Feeds Plc has demonstrated robust financial performance driven by strong revenue growth and effective cost management strategies, despite facing increased financial costs during the period.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate